A Deep Dive into the Future AI Dominance and Market Prospects of Nvidia

The Future of Nvidia Stock: In recent times, Nvidia (NVDA) has emerged as a juggernaut in the world of artificial intelligence (AI), thanks to its groundbreaking graphics processing units (GPUs) and proprietary software, such as the powerful Cuda platform for AI development. As the company continues to shatter expectations and deliver impressive financial results, it’s time to examine what lies ahead for this semiconductor giant.

Q2 Earnings and Beyond: Nvidia’s second-quarter earnings report, released on August 23, 2023, sent shockwaves through the market. The company has been consistently offering ambitious revenue forecasts, and each time, they’ve not only met but exceeded these expectations. The most recent earnings report showcased Nvidia’s ability to generate $13.5 billion in revenue, surpassing its earlier forecast of $11 billion. Now, the company is boldly predicting $16 billion in revenue for the upcoming October quarter.

It’s crucial for investors to recognize that Nvidia is undergoing a substantial transformation. Conventional valuation metrics, like trailing earnings and revenue, are becoming increasingly irrelevant. The company stands on the precipice of a monumental, lucrative opportunity, and this transformation is only in its infancy.

Fair Value Estimate: Our fair value estimate for Nvidia is a staggering $480 per share, reflecting an equity value of over $1.1 trillion. This estimate hinges on a fiscal 2024 price/adjusted earnings multiple of 45 times and a fiscal 2025 forward price/adjusted earnings multiple of 31 times.

This valuation is intrinsically linked to Nvidia’s performance in the data center business and AI GPUs. With the AI processor market poised for massive growth in the coming decade, Nvidia is well-positioned to capitalize on this trend. However, it’s important to note that competition from external chipmakers like AMD and in-house solutions developed by tech giants such as Alphabet, Amazon, and others will be factors to contend with.

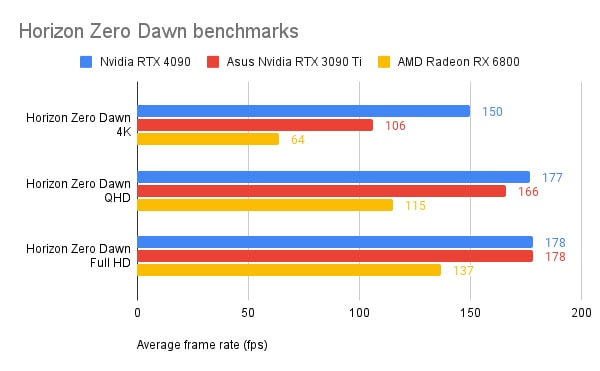

Economic Moat Rating: Nvidia boasts a wide economic moat, primarily due to intangible assets surrounding its GPUs and proprietary software. The company’s dominance in the discrete GPU market, with a market share exceeding 80%, is attributed to intangible assets related to GPU design and the essential software, frameworks, and tools that developers rely on to harness the power of these GPUs.

Recent innovations, including ray-tracing technology and AI tensor cores for gaming applications, reaffirm Nvidia’s GPU leadership. Notably, the company often commands significantly higher average selling prices compared to its closest competitor, AMD.

Risk and Uncertainty: Nvidia faces a landscape of very high uncertainty. The firm’s valuation is intricately tied to its ability to expand within the data center and AI sectors. While it currently leads in GPUs used for training AI models, competition is intensifying, with major cloud vendors seeking to reduce reliance on Nvidia and explore alternative solutions. This includes the development of in-house chips and software.

Google’s TPUs, Amazon’s Trainium and Inferentia chips, Microsoft’s semiconductor plans, and Meta Platforms’ efforts are all indicators of this competitive push. Additionally, existing semiconductor vendors like AMD and Intel are rapidly expanding their GPU offerings to cater to the growing demand from cloud leaders.

Bulls and Bears: Nvidia’s ascent in AI and GPU technology is undeniable. Industry-leading parallel processing capabilities, a dominant position in AI model training, and a pioneering role in the autonomous driving market all bolster the bullish case.

However, bears point to the looming threat of powerful chipmakers and tech giants investing heavily in in-house chip development. While Cuda remains a leader in AI training software, leading cloud vendors may favor increased competition in this space, potentially shifting to alternative open-source tools.

Conclusion: Nvidia’s journey into the heart of AI dominance is a remarkable saga. With a wide economic moat and a vision set on the future, the company seems poised to continue its impressive growth. Yet, it must navigate the turbulent waters of competition and evolving technology landscapes to secure its place at the forefront of the AI revolution.

As Nvidia redefines the boundaries of what’s possible in the world of semiconductors and AI, investors and tech enthusiasts alike will watch with bated breath, knowing that this trillion-dollar question may hold the key to the next era of technological innovation.

Nvidia’s Unstoppable Billion-Dollar Surge in the AI Market Revealed – The Future Looks Astonishing!

Nvidia Soars as Tech Titans Stumble: August proved to be a whirlwind for mega-cap technology stocks, with Nvidia Corp (NASDAQ: NVDA) defying the trend and reaching new heights. While giants like Apple (NASDAQ: AAPL), Microsoft Corp (NASDAQ: MSFT), and Meta Platforms Inc (NASDAQ: FB) faced setbacks, Nvidia’s market capitalization surged. Join us as we dissect the events that shaped this transformative month in the tech world.

Nvidia’s Spectacular Rise: Nvidia’s remarkable performance in August stemmed from its robust profit forecasts. In a climate where rising U.S. bond yields sent shockwaves through the tech sector, Nvidia stood tall. The company’s shares skyrocketed, driven by a quarterly revenue forecast that outpaced analyst predictions. As the AI revolution continues to drive demand for its chips, Nvidia’s future looks brighter than ever. Furthermore, the announcement of a massive $25 billion share buyback initiative sent its shares even higher.

The Tech Titans’ Rollercoaster Ride: In stark contrast, other technology giants faced a challenging August. Apple and Microsoft Corp experienced a 4.4% and 2.4% decline in market capitalization, respectively. Meta Platforms Inc fared even worse, with a 7.1% dip in its shares. Apple’s woes were compounded by a sales slump, primarily attributed to reduced demand for its flagship product, the iPhone.

Meanwhile, Berkshire Hathaway (NYSE: BRK.A) defied the odds, witnessing a 2% rise in market capitalization. The company’s shares hit a record high as its quarterly operating profit exceeded a monumental $10 billion for the first time. Rising interest rates bolstered profits from fixed-income investments, while fewer accident claims contributed to the success of Geico car insurance, a subsidiary of Berkshire Hathaway.

A Tale of Contrasts: Over in China, Tencent Holdings (HKG: 0700) saw a 9% decline in market capitalization. The core gaming business faced unexpected challenges in the quarter ending in June, contributing to the company’s struggles.

On the global stage, Johnson & Johnson (NYSE: JNJ) experienced a turbulent August, shedding about 10% in market capitalization. The company’s attempt to resolve a multitude of talc-related lawsuits was thwarted by a U.S. judge for the second time.

Nvidia’s Promising Future in the AI Market: August was a month of divergence in the tech world, with Nvidia’s stellar performance standing out amidst the struggles of industry giants. As the AI boom continues to reshape the landscape, it’s clear that Nvidia is leading the charge. Join us as we delve deeper into these market dynamics, unraveling the key factors that propelled Nvidia to new heights while others faced headwinds.

Unstoppable Rise: How Nvidia Stocks and ServiceNow’s AI Partnership Are Defying Cloud Slowdown – Must-Read Insights!

Powered by Nvidia Partnership and AI: In a year where the cloud-computing industry has seen a slowdown due to economic challenges and inflation, one theme remains robust: artificial intelligence (AI) and automation. As companies tighten their budgets and seek ways to do more with less, ServiceNow has defied the trend affecting many cloud software companies. A pivotal partnership with Nvidia announced earlier this year could further solidify the company’s leading position.

A Full-Blown Automation Platform: ServiceNow offers a software-based platform designed to help businesses digitize their workflows. Whether it’s tasks related to technology, employees, or customers, ServiceNow facilitates data integration across organizations, pinpointing inefficiencies that can be automated or eliminated to boost productivity.

In essence, ServiceNow’s software is tailor-made for the economic landscape of 2023, where maximizing profit margins is paramount.

Earlier this year, ServiceNow announced its integration of Nvidia’s new AI chips and AI training software, enhancing the efficiency of its platform. In return, Nvidia gains access to ServiceNow’s AI products, aiding its own research and development endeavors.

More recently, ServiceNow, Nvidia, and tech services giant Accenture expanded their partnerships to create AI Lighthouse, an all-encompassing computing solution aimed at helping early adopters harness the potential of generative AI.

Sailing Through the Cloud Slowdown: ServiceNow’s financial results stand as compelling evidence of the value it delivers to customers. In the second quarter, subscription revenue surged by 25% year over year, reaching nearly $2.1 billion. The outlook for full-year subscription revenue growth was revised upwards to at least 25.5% over 2022, amounting to about $8.6 billion.

For context, full-year 2022 subscription revenue grew by 24%, signaling an acceleration in 2023—a testament to ServiceNow’s ability to empower customers to navigate economic uncertainties. In contrast, many subscription-software peers have experienced a significant revenue growth slowdown this year as customers tighten their budgets.

ServiceNow has also maintained profitability on a free-cash-flow basis for some time. Notably, net income under generally accepted accounting principles (GAAP) is rapidly closing the gap with free cash flow. The primary reason for the difference, employee stock-based compensation (SBC), is diminishing, with the free-cash-flow profit margin expected to reach a robust 30% this year.

Is the Stock a Buy?

While the impact of new hardware and AI software installations from partners like Nvidia will take time to reflect in ServiceNow’s financials, the company continues to thrive independently. The stock currently trades at a premium of 50 times trailing-12-month free cash flow—a valuation well-deserved given the consistent and profitable growth demonstrated by this top-tier cloud software business over the years.

Management’s forecast promises more profitable growth in the foreseeable future. For investors in search of prime software stocks, ServiceNow ranks as a compelling choice, especially as a dollar-cost averaging candidate.

In a landscape where AI and automation reign supreme, ServiceNow’s strategic partnerships and enduring success make it a standout performer in the cloud software arena.

FAQ(s) about Nvidia

Q1. What exactly does Nvidia do?

Nvidia is renowned for its cutting-edge GPU designs, catering to a diverse range of sectors, including gaming, cryptocurrency mining, and professional applications. Additionally, the company produces chip systems specifically tailored for applications in vehicles, robotics, and various other tools.

Q2. Why did Apple stop Nvidia?

Apple was once in a close collaboration with NVIDIA until 2008. During 2007 and 2008, Apple introduced Macbook Pro models featuring the ill-fated NVIDIA GeForce 8400M and 9400M. Regrettably, these GeForce chips were plagued by a manufacturing defect in the chip die, resulting in premature GPU failures.

Q3. Is Nvidia the leader in AI?

As the foremost producer of chips for artificial intelligence, Nvidia (NVDA) stands as the prime example of the AI stock surge. In the current year, Nvidia’s stock has witnessed a remarkable surge of more than 230%, driven by a consistent stream of AI technology breakthroughs, collaborations, and customer disclosures.

Q4. Does Tesla use Nvidia chips?

Tesla has had a longstanding partnership with Nvidia, and the electric vehicle manufacturer has been utilizing a supercomputer powered by Nvidia’s technology. However, due to the surging demand for Nvidia’s chips driven by the AI boom, customers like Tesla are feeling the strain. In response, Elon Musk has revealed that Tesla is in the process of developing its own custom silicon-powered supercomputer, known as Dojo.

Q5. What is Nvidia famous for?

Established in 1993 by three American computer scientists, Jen-Hsun Huang, Curtis Priem, and Christopher Malachowsky, NVIDIA has gained renown for its development of integrated circuits. These circuits find applications in an array of devices, spanning from electronic game consoles to personal computers (PCs).

Q6. Does Google use Nvidia?

Apart from maintaining the most environmentally friendly cloud infrastructure within the industry, Google collaborates with NVIDIA to provide GPUs capable of enhancing the energy efficiency of demanding computational tasks, such as AI workloads.