India Emerges as a Key Growth Market for Global Corporations

In a pivotal move towards diversifying supply chains beyond China, global corporations such as Apple Inc. have significantly ramped up their production operations in India. JPMorgan, a prominent Wall Street bank, predicts that India could be one of the top three fastest-growing markets in the Asia Pacific region in the upcoming year, standing alongside Australia and Japan.

Filippo Gori, CEO for Asia Pacific at JPMorgan, highlighted the growing enthusiasm for the “China plus one” strategy, indicating a global trend where businesses seek alternatives to China for their supply chains. He noted that India stands to benefit the most due to its extensive capabilities to absorb a substantial portion of the global supply chain.

India, as Asia’s third-largest economy, is anticipated to showcase impressive growth of 6.5 percent in the financial year ending March 31, 2024—the highest among major economies. The Indian government is actively working to attract global corporations through various incentives, including tax benefits, to further fuel this growth.

However, Gori pointed out a notable challenge—India lacks the uniform and organized infrastructure seen in China, making it crucial to address this aspect to effectively accommodate the shifting supply chains. While low-end manufacturing is transitioning out of China, high-end manufacturing has yet to follow suit.

Despite the overall slowdown experienced across the region, inquiry and activity levels in India are notably increasing, according to Filippo Gori. JPMorgan has shown its commitment to this emerging market by expanding its investment banking team and bolstering its commercial banking division, focusing on mid-sized companies. Additionally, its corporate center business, handling offshoring-related operations, has significantly grown its workforce over the past few years.

Addressing concerns about the slowdown in China and its potential impact, Gori emphasized that JPMorgan’s business volumes in the market have remained resilient. The bank’s primary client base comprises international companies operating offshore in China, and their operations have not been significantly impacted by geopolitics.

In conclusion, India’s position as a prominent growth market for global corporations is strengthening, positioning it as a prime player in the evolving landscape of supply chain diversification.

India’s Rising Economic Appeal: JPMorgan Includes Indian Government Bonds in Emerging Market Index

In a testament to India’s growing allure for international investors, JPMorgan Chase & Co. has made a pivotal decision to include Indian government bonds in its benchmark emerging-market index. This move, set to commence on June 28, 2024, is eagerly anticipated to spur billions in foreign investments into India’s debt market.

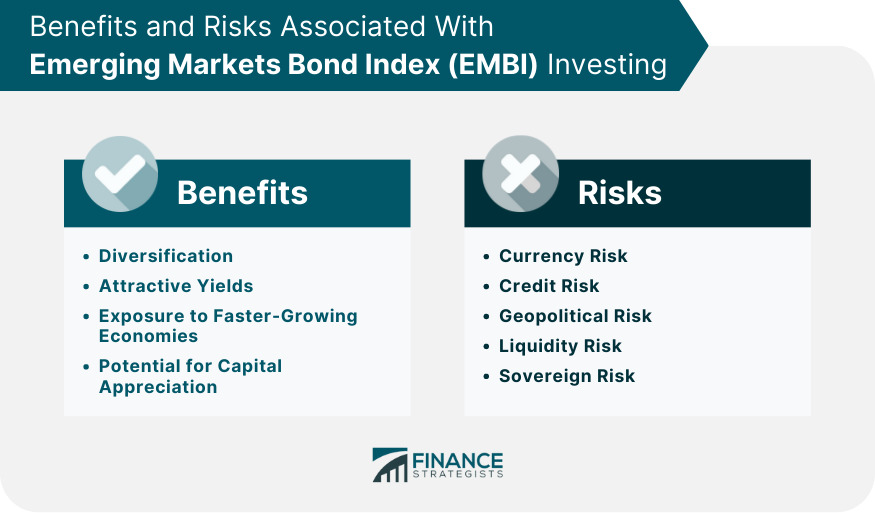

India’s burgeoning economic growth, expanding geopolitical influence, and the search for alternatives to China by global giants like Apple Inc., are fueling its appeal to international investors. Although foreign involvement in the Indian bond market has been relatively modest, recent years have seen a noticeable uptick in inflows, and India’s assets have demonstrated resilience amidst financial volatility affecting other developing nations.

The decision to include Indian securities in the JPMorgan Government Bond Index-Emerging Markets follows India’s introduction of the FAR program in 2020 and substantial market reforms aimed at facilitating foreign portfolio investments. According to JPMorgan’s index research team, almost three-quarters of benchmark investors surveyed favored India’s inclusion in the index.

This milestone for India stands in stark contrast to many emerging-market peers, particularly neighboring China, grappling with economic challenges and financial market struggles that have frustrated global investors. Consequently, India’s attractiveness has been further amplified.

Foreign investors have already infused $3.5 billion into Indian government debt this year, a figure that could potentially surge to $30 billion with greater access provided to global investors, as projected by HSBC Holdings Plc.

On the equities front, India has emerged as a prime investment destination among major emerging markets, driven by its rapidly growing economy and robust corporate earnings, propelling the nation’s equity benchmark close to an all-time high.

While concerns about rising oil prices and prolonged higher US interest rates have triggered outflows from local shares in September, overseas investors have net bought nearly $16 billion this year, marking the most substantial annual inflow since 2020.

The inclusion of Indian securities in the JPMorgan Government Bond Index-Emerging Markets is expected to attract more foreign capital into India, especially with inflation coming under control, according to Charu Chanana, a strategist at Saxo Markets in Singapore.

This move had been anticipated as global index providers seek to diversify index constituents. Russia’s invasion of Ukraine resulted in its exclusion from indexes, and China’s economic challenges have diminished its allure in the sovereign debt market. Consequently, India stands as the last significant emerging market yet to join others like China on the global debt indexes. Assets totaling $236 billion track the JPMorgan emerging market bond indexes.

However, Indian authorities have been relatively steadfast in resisting changes to tax policies that would facilitate the addition of securities to global indexes. In contrast, Korea, another substantial emerging market, has taken steps to enhance foreigners’ access by signing an agreement to open an omnibus account with Euroclear Bank SA.

Presently, 23 bonds, amounting to a combined notional value of $330 billion, are eligible for inclusion in the index, as per JPMorgan’s assessment. The inclusion will occur over 10 months, with approximately 1% weight added each month.

In anticipation of this inclusion, foreigners have significantly increased their holdings of these bonds, reaching almost $12 billion from $7.4 billion at the end of 2022, as per Clearing Corp. of India data. The rupee has also demonstrated strength, trading 0.4% higher in offshore trading early Friday, while the bond market was yet to commence trading.

Additionally, FTSE Russell, another major index provider, is closely watching India’s bonds for potential inclusion in its emerging market gauge.

In summary, India’s inclusion in JPMorgan’s emerging-market index underscores its growing economic appeal to international investors. This development is poised to channel substantial foreign investments into India’s debt market, reflecting its robust economic trajectory and solidifying its position among the top investment destinations in major emerging markets.

Breaking Boundaries: India’s Inclusion in JPMorgan Emerging Markets Index Set to Attract Billions

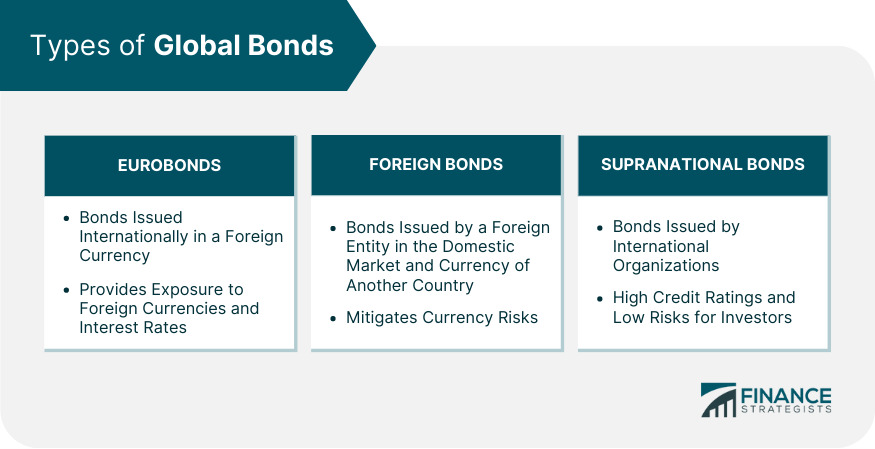

In a groundbreaking move, JPMorgan Chase & Co. announced the historic inclusion of Indian government bonds in its Government Bond Index-Emerging Markets (GBI-EM) starting June 2024. This pivotal step marks a first for India and is anticipated to unleash a surge of investments, potentially amounting to billions of dollars, into the country’s local currency-denominated government debt. Additionally, it is expected to have a positive impact on bond yields while offering support to the rupee.

What Drove this Momentous Decision?

India initiated discussions regarding the inclusion of its securities in global indexes as early as 2013. However, restrictions on foreign investments in domestic debt posed a hindrance. In a transformative move, the Reserve Bank of India introduced a set of securities in April 2020 that were exempt from these restrictions, allowing them to be included in global indexes through a “fully accessible route” (FAR).

Currently, 23 Indian Government Bonds (IGBs) with a collective notional value of $330 billion are now eligible for indexing, as affirmed by JPMorgan. Impressively, around 73% of benchmarked investors voiced their support for India’s inclusion.

Anticipating Inflows and Their Impact

JPMorgan stated that Indian bonds would ultimately hold a weight of 10% in its index, with a 1% addition to its weightage each month commencing from June next year. Analysts estimate that this inclusion could bring in inflows nearing $24 billion over this 10-month transition period, a considerable upsurge from the $3.5 billion invested by foreign entities in Indian debt this year alone.

This potential influx is expected to significantly impact foreign holdings of outstanding bonds, potentially elevating them to 3.4% by April-May 2025 from the current 1.7%. This will positively influence India’s fiscal landscape.

Impact on Bond Yields and Borrowing Costs

With India grappling with a high fiscal deficit, targeted at 5.9% of GDP for the year ending March 31, 2024, the government is set to borrow a record-breaking 15 trillion rupees (approximately $181 billion). Historically, banks, insurance companies, and mutual funds have been the primary buyers of government debt. The fresh source of funds from international investors is expected to help cap bond yields and mitigate the government’s borrowing costs. Traders estimate that the benchmark bond yield could decline by 10-15 basis points to reach 7% over the next few months, benefiting both the government and corporate borrowers.

The Ripple Effect on the Rupee

Anticipated larger debt inflows from the next financial year will alleviate the pressure on India to finance its current account deficit, which is estimated at $81 billion for the upcoming financial year by IDFC First Bank. The inflows associated with index inclusion, projected at close to $24 billion, are poised to cover a substantial part of this deficit, thereby bolstering the Indian rupee.

However, it’s essential to acknowledge that the amplified foreign flows could introduce volatility in both the bond and currency markets. This might necessitate proactive intervention from both the government and the central bank to maintain stability and ensure a harmonious financial landscape.

In conclusion, India’s integration into JPMorgan’s Emerging Markets Index represents a pivotal moment, promising to shape the nation’s economic trajectory. The anticipated surge of investments underscores India’s growing appeal on the global stage, amplifying its position as a key investment destination among major emerging markets.

Unlocking Opportunities: India’s Inclusion in JPMorgan Emerging Market Debt Index

In a groundbreaking announcement, global investment giant JPMorgan Chase & Co. revealed its decision to incorporate Indian securities into its prestigious emerging market debt index, the JPMorgan Government Bond Index-Emerging Markets (GBI-EM). Effective June 28, 2024, this move is expected to have a profound impact on India’s debt market, and here’s a comprehensive look at what it means for investors.

Understanding the JPMorgan GBI-EM Index

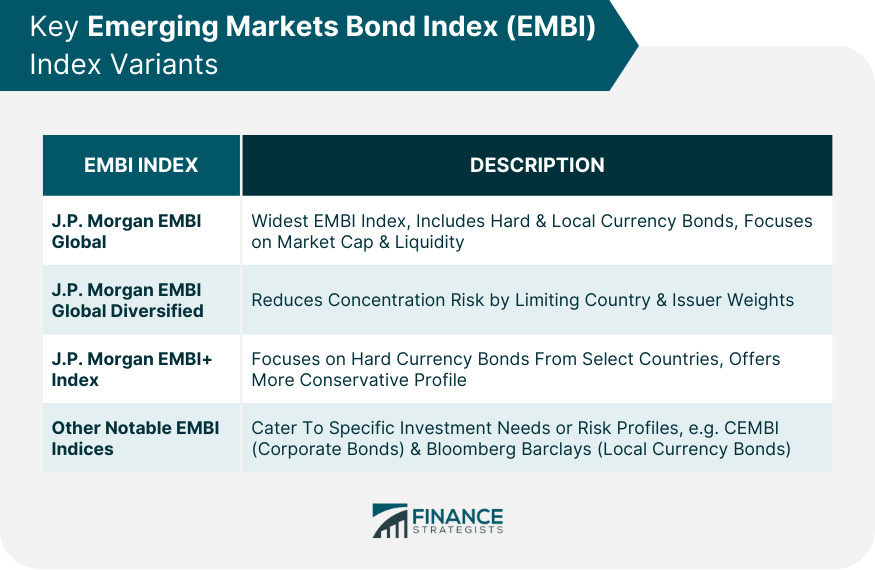

The JPMorgan GBI-EM Index, formally known as the JPMorgan Government Bond Index-Emerging Markets (GBI-EM), is an esteemed benchmark that guides investors towards higher-yielding local rates. This index has set a new standard for local market benchmarks, including government debt securities from several countries worldwide.

As of August 1, 2023, the index comprised government debt securities from nations such as China, Malaysia, Philippines, Czech Republic, Hungary, Poland, Romania, Serbia, Turkey, Brazil, Colombia, Dominican Republic, Mexico, Peru, Uruguay, and South Africa.

JPMorgan’s Announcement and its Implications

JPMorgan made a significant announcement, confirming the addition of Indian securities to the JPMorgan GBI-EM index, commencing on June 28, 2024. Presently, 23 bonds with a combined notional value of $330 billion are eligible for inclusion in the index.

India will hold a maximum weightage of 10% on the index. The inclusion process will be staggered over 10 months, with an approximate 1% weight added each month.

Positive Prospects for India’s Debt Market

This move is widely regarded as highly favorable for India’s debt market, poised to attract billions of foreign inflows. HSBC Holdings Plc has estimated that granting global investors enhanced access could potentially drive inflows of up to $30 billion into the Indian debt market. Notably, foreign investors have already purchased $3.5 billion worth of Indian government debt this year, according to Bloomberg data.

Emkay Global Financial Services, in a recent report, emphasized the substantial benefits India stands to gain from this inclusion. It stated that being part of JPMorgan’s GBI-EM index would lower India’s risk premium and cost of funding, enhance liquidity and ownership of government securities, and assist in financing India’s fiscal and current account deficit. This strategic move is expected to promote more accountable fiscal policy-making in the foreseeable future.

In the near term, Emkay anticipates that bond yields and the Indian rupee may experience fluctuations following the initial enthusiasm, in line with global market trends. However, the trend is predicted to reverse in favor of bonds by end-March 2024, with the 10-year yield anticipated to fall below 7 percent.

In summary, India’s inclusion in the esteemed JPMorgan GBI-EM index signifies a monumental step forward, unlocking promising opportunities for the nation’s debt market. The foreseen influx of foreign investment underscores India’s growing prominence on the global financial stage, solidifying its position as an enticing investment destination in the emerging markets landscape.

JPMorgan’s Game-Changing Move: Indian Bonds to Shine on Global Stage

In a momentous move, JPMorgan Chase & Co., a leading global financial firm, has announced its intent to include Indian government bonds, also known as government securities (G-Secs), in its prestigious benchmark emerging market index. Starting from June 2024, this decision is set to significantly impact India’s financial landscape. Here’s a detailed exploration of the implications and potential outcomes stemming from this transformative development.

A Strategic Inclusion

JPMorgan’s decision to include Indian government bonds in its benchmark emerging market index is a significant step that holds promise for India’s financial market. The inclusion of G-Secs is scheduled to take place over a 10-month period, commencing from June 28, 2024, and concluding on March 31, 2025, with a one percent increment in its index weight each month.

Widening the Investor Base

Chief Economic Adviser V Anantha Nageswaran highlighted the broadening of the investor base for Indian government bonds as a key benefit of this inclusion. This move is expected to reduce the pressure on Indian financial institutions, previously prominent buyers or subscribers of government bonds, allowing them to redirect funds towards more productive purposes within the private and commercial sectors.

Potential for Currency Appreciation

Moreover, the inclusion of Indian bonds in JPMorgan’s index could potentially lead to the appreciation of the Indian rupee. Drawing parallels to the surge in capital inflows between 2003 and 2008, Mr. Nageswaran pointed out the tendency for currency appreciation following increased demand for Indian government securities.

An Opportune Move

This announcement aligns with the Indian government’s broader strategy to facilitate greater participation from non-resident investors. In the 2020-21 Budget speech, Union Finance Minister Nirmala Sitharaman disclosed plans to fully open certain specified categories of government securities to non-resident investors, a long-awaited move that has now come to fruition.

Anticipating Positive Growth

With this strategic inclusion, India is poised to attract significant interest from global investors. As the demand for Indian government securities rises, this move is expected to drive currency appreciation and bolster India’s financial market. Moreover, it aligns with the broader goal of promoting a more diversified and investor-friendly market.

In summary, JPMorgan’s decision to include Indian government bonds in its benchmark emerging market index marks a significant milestone for India’s financial sector. The ensuing widening of the investor base and the potential for currency appreciation are indicators of positive growth on the horizon. As the inclusion period approaches, all eyes will be on India’s financial market to witness the transformative impact of this strategic move.