Surge in U.S. Mortgage Rates Hits Highest Point Since 2002

The average 30-year fixed-rate mortgage has surpassed the 7 percent mark, presenting a formidable challenge for potential homebuyers already grappling with limited housing inventory. This surge in mortgage rates, reaching a 21-year pinnacle, further complicates the affordability of homes within a market characterized by elevated prices and constrained supply.

Freddie Mac disclosed that the average 30-year fixed-rate mortgage, a widely favored home loan option in the United States, surged to 7.09 percent from 6.96 percent the previous week. In comparison, the rate was 5.13 percent a year ago.

Experts anticipate that mortgage rates will persist at these elevated levels in the near future, with a gradual easing projected by year-end. This current rate represents the highest recorded since April 2002. In the aftermath of this milestone, prospective homebuyers encountered a period of falling rates, some even dropping below 3 percent during the early stages of the pandemic.

Nonetheless, the abrupt ascent of mortgage rates, triggered by the Federal Reserve’s efforts to combat swift inflation through interest rate hikes, has led to stagnation in the housing market. Homeowners holding onto low mortgage rates have been reluctant to list their properties for sale. In June, existing home sales plummeted by nearly 19 percent compared to the prior year, according to the National Association of Realtors. The scarcity of available listings has contributed to sustaining elevated housing prices. The median cost of existing homes in June was $410,200, the second-highest since data tracking began in 1999, only slightly down from the $413,800 peak recorded a year ago.

Analysts predict that the housing market’s robustness is unlikely to wane soon. Goldman Sachs recently revised its home price projections upwards, forecasting a 1.8 percent increase in prices for the current year and a 3.5 percent surge in 2024. The bank’s analysts attributed this to a constrained housing supply and consistent demand for homes. This situation isn’t favorable news for aspiring homeowners like Kathleen Schmidt, who expressed discouragement at the spike in mortgage rates as she aimed to save for a down payment.

Challenges around affordability persist in the housing market, noted Jeff Ostrowski from Bankrate, as he predicted an extended period of high rates. With existing homes in short supply, potential buyers are gravitating towards new construction. Census Bureau data revealed a nearly 24 percent increase in the sale of new homes in June compared to the previous year. Meanwhile, housing starts experienced a roughly 6 percent uptick in July year-on-year.

While national builders focus more on higher-priced homes to satisfy investor expectations, the scarcity of affordable options persists for homebuyers. As the Federal Reserve continues to address inflation by raising its policy interest rate, borrowing costs across the economy rise, posing further challenges to potential homeowners.

The trajectory of mortgage rates hinges on factors including inflation expectations, the Federal Reserve’s actions, and investor responses. The yield on 10-year Treasury bonds often mirrors mortgage rates and is influenced by these same factors. Recently, the 10-year yield surpassed 4.3 percent for the first time since 2007.

Market participants and prospective homebuyers alike are left wondering how long this elevated mortgage rate environment will persist. Experts such as Lawrence Yun anticipate a gradual decline by next spring or year’s end, with rates potentially dropping to 6.5 percent, although this would still be more than twice the rate observed in 2021. Nonetheless, the Federal Reserve’s battle against inflation and the nation’s credit rating downgrade continue to exert upward pressure on mortgage rates.

In summary, the housing market faces significant challenges as mortgage rates soar, leaving potential buyers and industry observers to speculate on the duration of this elevated rate environment.

U.S. Mortgage Rates Skyrocket to a 21-Year High: Full Story in short

Mortgage Rates Reach 21-Year High at 7.09%, Signaling Increased Borrowing Costs

The 30-year fixed-rate mortgage surged to a 21-year high, reaching 7.09% in the week ending Thursday, as revealed by data released by Freddie Mac on the same day.

Compared to the previous week’s 6.96%, this significant uptick in the average 30-year fixed-rate mortgage marked a notable escalation in borrowing costs.

The Federal Reserve’s determined approach of implementing consecutive interest rate hikes aims to curb inflation by slowing economic activity and suppressing demand.

Consequently, borrowers now face elevated expenses across various sectors, including car loans, credit card debts, and home mortgages.

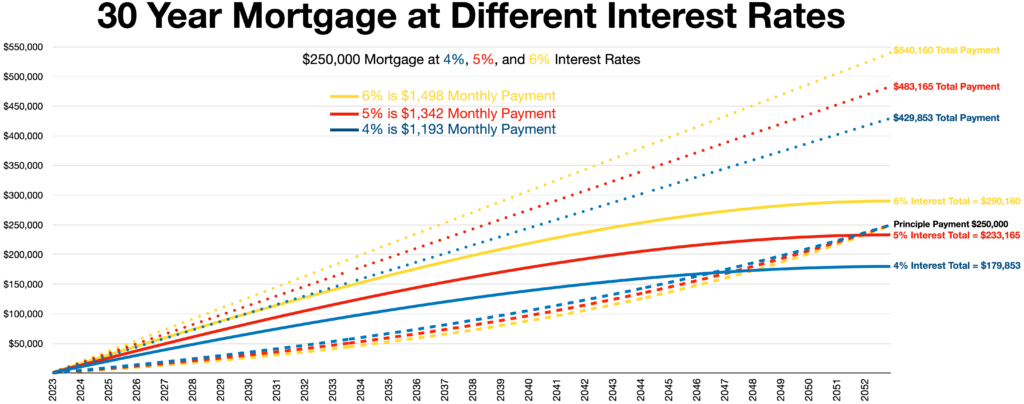

Back in March 2022, when the current series of rate hikes commenced, the average 30-year fixed mortgage rate stood at a mere 4.45%, based on data from Mortgage News Daily. Rocket Mortgage further underlined that every percentage point increase in mortgage rates can result in thousands to tens of thousands of additional costs annually, contingent upon the property’s price.

Freddie Mac data has consistently shown the average 30-year fixed mortgage rate exceeding 6.5% since May. In a previous peak during the current rate hike cycle, the rate reached 7.08% in November.

While the surge in home-buying expenses has indeed dampened demand, Freddie Mac’s statement on Thursday attributed the stagnation in the housing market primarily to a scarcity of supply.

Although the rate hikes have somewhat tempered economic growth, they have yet to put the nation’s economic trajectory in jeopardy. Notably, a substantial upward revision in government data for June indicated a 2% annualized growth in gross domestic product for the three-month period ending in March—a considerable jump from the earlier estimate of 1.3%.

Federal Reserve Chair Jerome Powell declared last month that the Fed staff no longer predicts a recession for the United States, reassuringly addressing concerns in a Washington, D.C. press conference.

Simultaneously, the interest rate hikes have played a pivotal role in reining in inflation from its peak of over 9% last summer. However, it still remains slightly above the Fed’s target rate by more than a percentage point. In July, consumer prices exhibited a minor acceleration, registering at 3.2% compared to the previous year, undoing some of the progress achieved in the battle against inflation.

Historical data from Freddie Mac disclosed that the last time the average 30-year fixed mortgage rate surpassed current rates was in March 2002, when it reached 7.18%. Two years prior, rates had peaked at 8.64%.

The trajectory of mortgage costs hinges partly on the Federal Reserve’s upcoming decisions regarding interest rates. The central bank is slated to announce its next interest rate resolution in mid-September.

FAQ(s) about Mortgage Rates

Q1. What is the meaning of mortgage rate?

A mortgage rate, also known as a mortgage interest rate, is a component of the overall expense incurred when borrowing funds from a lender. Rather than making a single payment to the mortgage lender, the interest amount is included as a component of your monthly payment for your housing loan.

Q2. What is the difference between mortgage rate and interest rate?

APR, which stands for Annual Percentage Rate, represents the yearly expense of a loan for a borrower, encompassing various fees. Similar to an interest rate, the APR is presented as a percentage. Unlike the interest rate, though, it encompasses additional expenses like mortgage insurance, major closing costs, discount points, and fees related to loan origination.

Q3. What is a mortgage rate example?

For a $200,000 fixed-rate mortgage spread over 30 years (with 360 monthly payments) and an annual interest rate of 4.5%, the estimated monthly payment will be around $1,013. (Additional costs like real-estate taxes, private mortgage insurance, and homeowners insurance are separate and not factored into this amount.)

Q4. What is the mortgage rate formula?

Lenders calculate your monthly interest payment by multiplying your remaining balance with your annual interest rate and then dividing by 12 to account for monthly payments. For instance, if your mortgage balance is $300,000 and your interest rate is 4%, your initial monthly interest payment will be $1,000 ($300,000 x 0.04 ÷ 12).

Q5. Are mortgage rates higher?

The average rate for a 30-year fixed mortgage stands at 7.39%, showing a rise of 5 basis points recently.

FAQ(s) about Housing Market

Q1. What is the meaning of housing market?

The term “housing market” can encompass: The economic aspects related to real estate utilized for residential purposes, as covered in real estate economics. The business activities associated with real estate, including the acquisition, sale, or leasing of properties such as land, buildings, or housing.

Q2. How is the housing market in the world 2023?

The housing market continues to experience sluggish activity primarily due to elevated mortgage rates, increased home prices, and limited housing supply. These three challenges combined are fueling the ongoing housing affordability crisis. Moreover, the presence of substantial inflation and the potential for additional interest rate hikes further contribute to the uncertain landscape.

Q3. What is the future of the housing market in the world 2023?

With mortgage rates staying elevated, the momentum of home sales, and in certain regions, even home prices, is slowing down. This prevailing uncertainty is casting a shadow over the real estate market. Given these conditions, it’s not surprising that numerous homeowners, potential sellers, and aspiring buyers are experiencing a sense of apprehension. Prices will remain fairly steady and in a lot of markets, that’s a price that is 40 percent or more higher than pre-pandemic.

FAQ(s) about Real Estate

Q1. What do you mean by real estate?

Real estate encompasses tangible property involving land and any enduring attachments or constructions, whether naturally occurring or human-made. Real estate is classified into five primary categories: residential, commercial, industrial, undeveloped land, and specialized usage properties.

Q2. Which real estate makes the most money?

Commercial properties are regarded as a top-tier choice for real estate investments due to their capacity for increased cash flow. Opting to invest in commercial real estate can offer enticing advantages such as the potential for greater income.